Our Expert Guidance: Making Informed Decisions

At BTS.TAX, we're here to guide you through complex financial decisions like early retirement account withdrawals and strategic investments for tax reductions. Our experienced team can help you understand the potential impact on your taxes, retirement goals, and overall financial well-being.

Before taking any action, consult with our tax experts to assess your situation comprehensively. We'll help you explore all available options, consider the tax implications, and develop a strategy that aligns with your financial objectives. Your financial future is our priority, and we're dedicated to providing the guidance you need to make informed decisions. Contact us today to discuss your specific circumstances and find the best path forward.

Maximizing Your Financial Goals

Strategic Investments for Tax Reduction

Welcome to our guide on making strategic investments to minimize your tax liability. Investing wisely not only helps you grow your wealth but can also provide opportunities to reduce your tax burden legally and efficiently.

Strategic Investments for Tax Reduction:

Maximizing Your Financial Goals

Key Investment Strategies for Tax Reduction

- Retirement Accounts: Contributing to retirement accounts like Traditional IRAs, 401(k)s, or SEP-IRAs can lower your taxable income while preparing for your future. These accounts offer tax-deferred growth, and in some cases, contributions may be tax-deductible.

- Health Savings Accounts (HSAs): HSAs allow you to save for medical expenses on a tax-free basis. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Municipal Bonds: Investing in municipal bonds can provide tax-free interest income at the federal level, and often at the state and local levels as well.

- Tax-Efficient Funds: Opt for tax-efficient mutual funds or exchange-traded funds (ETFs) that generate less taxable income, reducing potential tax liabilities.

- Capital Gains Planning: Consider holding investments for more than one year to qualify for long-term capital gains tax rates, which are often lower than ordinary income tax rates.

- Tax-Loss Harvesting: Offset capital gains with capital losses by selling investments that have declined in value, helping to reduce your overall taxable income.

- Real Estate Investment: Real estate investments, like rental properties, can offer various tax deductions, including mortgage interest, property taxes, and depreciation.

- Qualified Opportunity Zones: Investing in designated opportunity zones can provide potential tax benefits, including temporary tax deferral and potential elimination of certain capital gains.

- Business Investments: For business owners, investing in your business's growth can lead to tax deductions, credits, and other tax benefits.

Our Expertise: Tailored Strategies for Your Financial Future

At BTS.TAX, our experienced team understands the intricate relationship between investments and taxes. We're here to help you develop personalized investment strategies that align with your financial goals while minimizing your tax exposure.

Whether you're an individual investor looking to optimize your portfolio or a business owner seeking tax-efficient investment options, we're dedicated to providing you with expert advice and solutions. Contact us today to explore how strategic investments can pave the way for financial success while strategically reducing your tax obligations.

What You Need to Consider

Early Retirement Account Withdrawals

Are you considering withdrawing funds early from your retirement account? It's essential to understand the implications before making this decision. While early withdrawals might seem like a solution to immediate financial needs, they can have lasting effects on your retirement savings and tax obligations.

Key Factors to Consider Before Withdrawing Early

- Penalties: Most retirement accounts impose an early withdrawal penalty if you take money out before reaching a specific age, usually 59½. This penalty can be a significant portion of your withdrawal, impacting your long-term savings.

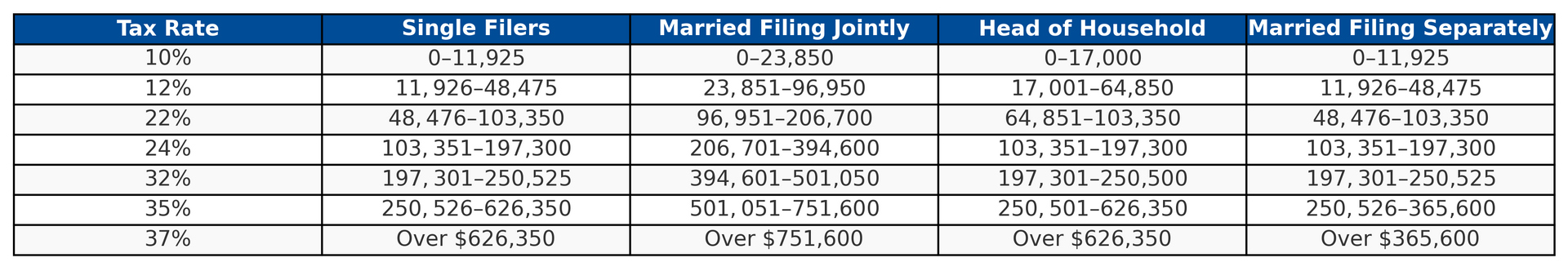

- Tax Consequences: Early withdrawals from traditional retirement accounts are generally considered taxable income. This means you'll owe income taxes on the withdrawn amount, potentially pushing you into a higher tax bracket.

- Lost Growth: Withdrawing funds early means missing out on the potential compounding growth of your investments. This could significantly impact your retirement savings over time.

- Impact on Retirement: Early withdrawals can disrupt your retirement planning. The funds you withdraw now might have provided security and financial stability during your retirement years.

- Alternatives: Before withdrawing early, explore alternative options such as taking out a loan, creating a budget, or tapping into emergency funds to avoid long-term financial repercussions.

- Hardship Withdrawals: Some retirement plans allow for penalty-free early withdrawals in cases of financial hardship. However, these withdrawals usually require meeting specific criteria and may still have tax consequences.

What Withholdings Should I Prepare for

The amount of money you can expect to pay for an early retirement withdrawal varies based on several factors. Early withdrawals from retirement accounts are typically subject to both income tax and a 10% early withdrawal penalty. However, the exact amount you'll pay depends on your individual tax bracket, the type of retirement account you're withdrawing from, and any exceptions that may apply.

For example, if you're in a higher tax bracket, a significant portion of your withdrawal might go toward income taxes. Additionally, if you're under 59½ years old, you'll likely incur the 10% early withdrawal penalty, unless you qualify for an exception, such as using the funds for medical expenses or a first-time home purchase.

It's essential to consult with a tax professional to get a more accurate estimate of the potential taxes and penalties associated with your specific early retirement withdrawal. They can help you understand the potential financial impact and explore any available exceptions or strategies to minimize the overall cost of the withdrawal.