IRS TAX REFORM UPDATES

The 2025 Tax Reform Act: What You Need to Know

Permanent Tax Law Changes

Several provisions from the 2017 Tax Cuts and Jobs Act are now permanent, including:

- Current individual income tax brackets

- The expanded standard deduction

- Elimination of personal and dependent exemptions

The new tax law expands deductions and credits for individuals and families, including tax-free treatment for certain tips and overtime pay, deductions for qualifying auto loan interest, and increased child tax credits. Seniors receive an additional deduction, while new “Trump Accounts” offer tax-advantaged savings for children. The SALT deduction cap is temporarily increased, providing short-term relief for taxpayers in high-tax states.

IRS provides tax inflation adjustments for tax year 2025

IRS 2025 Tax Season Updates

2025 Tax Year Overview

(For Returns Filed in Early 2026)

The 2025 tax year reflects several major updates introduced under the One Big Beautiful Bill Act (OBBBA), signed into law in July 2025. The legislation extends key elements of prior tax reform while introducing new deductions and adjustments that affect individuals and families. Some incentives are temporary, while others are now permanent parts of the tax code.

New Deductions and Key Changes

Several new deductions are available for tax years 2025 through 2028 and may be claimed even if you do not itemize. These are reported using Schedule 1-A (Form 1040).

Senior Deduction

Taxpayers age 65 or older may claim an additional deduction of up to $6,000, or $12,000 for married couples where both spouses qualify, subject to income limitations.

Tip Income Deduction

Eligible workers may deduct up to $25,000 of qualified tip income. This benefit phases out for higher-income taxpayers.

Overtime Income Deduction

Taxpayers may deduct up to $12,500 in overtime pay ($25,000 for joint filers) for wages earned above their standard hourly rate, as defined under federal labor rules. Income limits apply.

Vehicle Loan Interest Deduction

Interest paid on a loan for a new, U.S.-assembled personal vehicle purchased after December 31, 2024, may be deductible up to $10,000, subject to income thresholds.

Standard Deduction & Tax Credits

Standard Deductions 2025 and will increase in 2026

- Single / Married Filing Separately: $15,750

- Head of Household: $23,625

- Married Filing Jointly / Qualifying Surviving Spouse: $31,500

Child Tax Credit

The maximum child tax credit increases to $2,200 per qualifying child, with up to $1,700 refundable.

State and Local Tax (SALT) Deduction

The SALT deduction cap is temporarily increased to $40,000 for both single and joint filers, with phaseouts for higher-income households.

Adoption Credit

The maximum adoption credit rises to $17,280, with up to $5,000 eligible for refundability.

Expiring and Permanent Provisions

Clean Energy Credits

- The New and Used Clean Vehicle Credits and the Commercial Clean Vehicle Credit expire for vehicles placed in service after September 30, 2025.

- Residential energy credits for home efficiency improvements and clean energy systems expire for property placed in service after December 31, 2025.

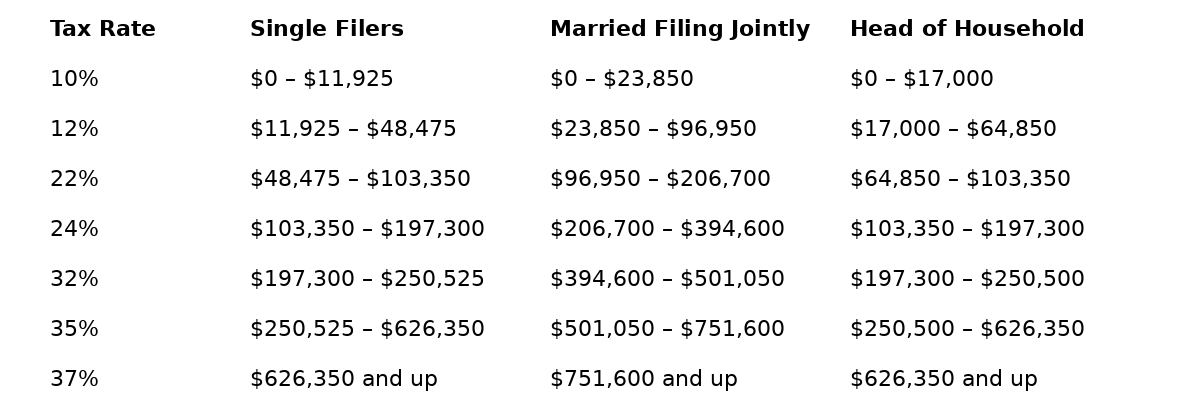

2025 Tax Brackets and Rates

Rates Projected based on information provided by the IRS in December of 2025. Rates may change. Check IRS for latest.

New & Expanded Tax Breaks

Deductions & Exemptions

- No tax on tips: Certain tip income excluded from taxable income (income limits apply).

- No tax on overtime: Qualified overtime pay may be excluded from taxation.

- Auto loan interest deduction: Interest on qualifying U.S.-assembled vehicles may be deductible.

Family & Child Benefits

- Expanded Child Tax Credit with higher annual amounts.

- Enhanced standard deduction remains in place, lowering taxable income for most filers.

Senior Tax Relief

- Additional deduction for taxpayers age 65+, subject to income limits.

Retirement & Savings

- Introduction of “Trump Accounts” — tax-advantaged savings accounts for children born between 2025–2028, including initial government contributions.

State & Local Tax (SALT) Deduction

The SALT deduction cap increases temporarily (up to ~$40,000), offering short-term relief for taxpayers in high-tax states before reverting to prior limits.