Plan withholding and manage your retirement income.

Managing Taxes on 401(k) Withdrawals and Social Security Benefits

When withdrawing funds from your 401(k) while receiving Social Security benefits, it's crucial to understand the tax implications to ensure appropriate withholding and avoid unexpected tax liabilities.

Taxation of 401(k) Withdrawals and Social Security Benefits

Withdrawals from a traditional 401(k) are considered taxable income and are taxed at your ordinary income tax rate. Receiving Social Security benefits may also be partially taxable, depending on your combined income, which includes:

- Adjusted Gross Income (AGI): Your total income minus specific deductions.

- Nontaxable interest: Interest income not subject to federal tax.

- Half of your Social Security benefits.

Withdrawing 401(k) Funds While Receiving Social Security: What’s New in 2025

When you withdraw from a traditional 401(k) while also receiving Social Security benefits, it's especially important to understand how taxes may change under the new law. The recent Big Beautiful Bill introduced a temporary “senior deduction” that affects how much Social Security income gets taxed—but it doesn’t fully eliminate the possibility of tax on benefits.

Below is a friendly, up-to-date guide to help you plan your withholding and avoid surprise taxes.

How the New Law Affects Social Security Taxation

- The Big Beautiful Bill introduces a new deduction (often called a “senior bonus deduction”) for taxpayers age 65 and older. This deduction is up to $6,000 for individuals (or up to $12,000 for married couples filing jointly).

- Importantly, this deduction does not change the rules for which portion of Social Security benefits gets taxed. Instead, it lowers your overall taxable income, which may reduce or eliminate tax on your benefits if your income is low enough.

- Under prior rules, if your

combined income (AGI + nontaxable interest + half of your Social Security) exceeds certain thresholds, a portion of Social Security might be taxed. For example:

• Individuals: between $25,000 and $34,000 → up to 50% taxed; above $34,000 → up to 85% taxed. Couples (married filing jointly) use higher thresholds

- Because of the new deduction, many with modest incomes may now fall below the thresholds that trigger Social Security taxation, meaning no tax may be owed on those benefits.

401(k) Withdrawals Are Still Taxed as Ordinary Income

Withdrawals from a traditional 401(k) remain fully taxable at your ordinary income tax rate. The Big Beautiful Bill does not change this fundamental rule.

When you take out funds from your 401(k), they are added to your taxable income for the year, which may affect your tax bracket and how much of your Social Security benefits become taxable.

Recommended Withholding (or Making Adjustments)

To avoid surprises at tax time, here’s how you can adjust withholding or make estimates under the new law:

SourceTypical WithholdingAdjustment Tips401(k) WithdrawalsMost custodians withhold 20% by defaultConsider increasing withholding or making quarterly estimated payments if your total income places you in a higher bracketSocial Security BenefitsYou can have federal tax withheld by submitting Form W-4V, choosing 7%, 10%, 12%, or 22%With the new senior deduction, you may find you need less withholding—revisit your elections after your full income picture is clear

Planning Tips Under the New Law

- Run your combined income estimate before the year ends—this helps you see if Social Security benefits will be taxed, or possibly fully shielded by the new deduction.

- Revisit withholding elections midyear, especially if you take a 401(k) distribution.

- Consult your tax professional—the new deduction and thresholds phase out at higher income levels, and individual situations vary.

Early Retirement Withdrawals

If you're considering early retirement, here’s what you need to know about withdrawals:

- Early Withdrawal Penalties: Generally, withdrawing from a retirement account before age 59½ incurs a 10% penalty, plus regular income tax on the amount withdrawn. However, there are exceptions for medical expenses, first-time home purchases, and certain qualified education expenses.

- Tax Implications: Early withdrawals can push you into a higher tax bracket, increasing your tax liability. Consider the timing of your withdrawals to minimize this impact.

- Strategic Withdrawals: Consider other sources of income first, like taxable brokerage accounts, to delay withdrawals from retirement accounts until later. This strategy could help you reduce taxes over time.

- Consider a Roth Conversion: If you’re in a lower tax bracket now, you might consider converting some of your traditional retirement savings to a Roth IRA, allowing tax-free withdrawals later.

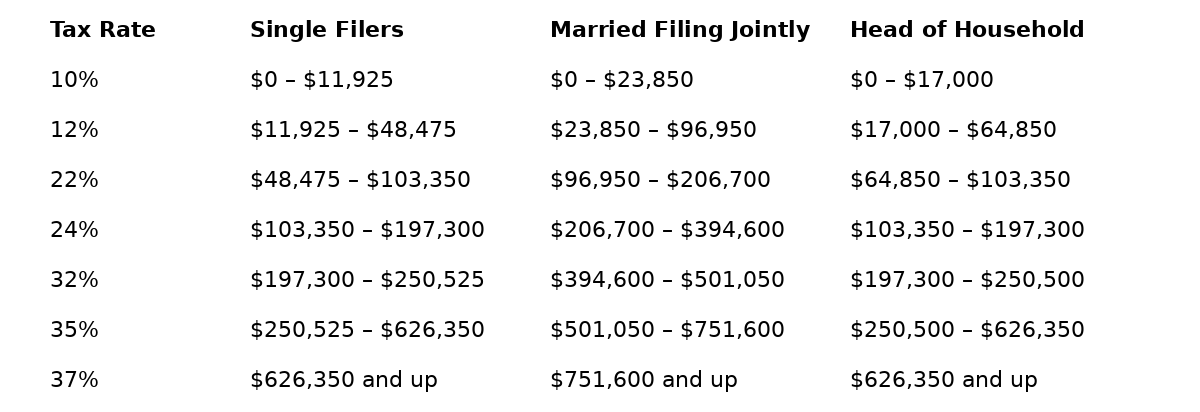

2025 Federal Income Tax Brackets

Additional Resources

For more detailed information, refer to the following IRS publications:

- Taxation of Social Security Benefits

- Retirement Topics – 401(k) and Profit-Sharing Plan Contribution Limits

By carefully planning your withdrawals and understanding the tax implications, you can effectively manage your income and tax obligations during retirement.