Online Tax Service

Your Online Income Tax Service Specialist

Personalized & Convenient Tax Services

No more long lines, waiting for someone to quickly throw in your data, and hope for the best. Completing your tax return just got a whole lot easier. Simply answer a few questions, upload your tax documents, and the tax specialist will do all the work. Then schedule a convenient time for a face to face review of your tax return through secure video conferencing. Once all completed your tax return will be e-filled with the IRS, any state(s), and city. You will also have year round access to a copy of your tax return. Just follow the steps below to get started. If you have any questions we are here to help.

Benefits of our online portal

Take back control of your time and money with the ease and benefits of our online portal. Listed below are some of the great services you will receive

- Responsive tax organizer helping you know what documents are needed

- Optional App with built-in scanner for uploading documents

- Direct phone extension and messaging to your dedicated personal tax specialist

- Scheduled updates as your tax return progresses

- Convenient scheduling calendar letting you pick the day and time for a review

- As always, you will receive an online face to face consultation with a comprehensive review of your tax return along with possible suggestions on how to improve for next year's return.

- Easy online secure payments and signature pages so we can get your tax return electronically filed with the IRS

- You receive a digital copy of your tax return which is available all year 24/7

- With our online portal you also receive IRS Support Assurance at no additional cost.

IRS Support Assurance

Utilize our user-friendly online portal and unlock the added benefit of IRS Support Assurance, all at no additional cost. At BTS.TAX, we stand by your side with expert assistance throughout IRS letters and audits. Expect clear communication, strategic solutions, and dedicated representation from our seasoned team. We streamline the process, safeguarding your rights and financial stability. Elevate your confidence with our unwavering guidance and comprehensive support.

Step by Step Instructions

Follow the steps below making this tax season a little more bearable. Once completed you'll have access to all your tax documents and finalized tax return ready at a moments notice should the need arise for a home loan or other various credit check requirements.

NOTE: If filing jointly an email address will be required for each signiture verifcation as required by IRS.

Phone App with Built-in Scanner

Don't have a Computer? Taxes by phone.

We understand not everyone has a computer. However, we do find most all have a cell phone. That's all you need. Our phone app makes it easy to completer your tax reurn online. Just simply sign in by creating a password, follow the easy to navigate client tax organizer and upload your documents through the built in scanner.

Creating Your Portal: Signing In

The first step is creating your new portal that will enable you to upload documents, chat with your tax professional, schedule to review your tax statement, sign any documents, and make payments.

Let's Get Started! Click on the "get Started" button where a new tab where you will be prompted to submit you email address and create a new password.

STEP

2

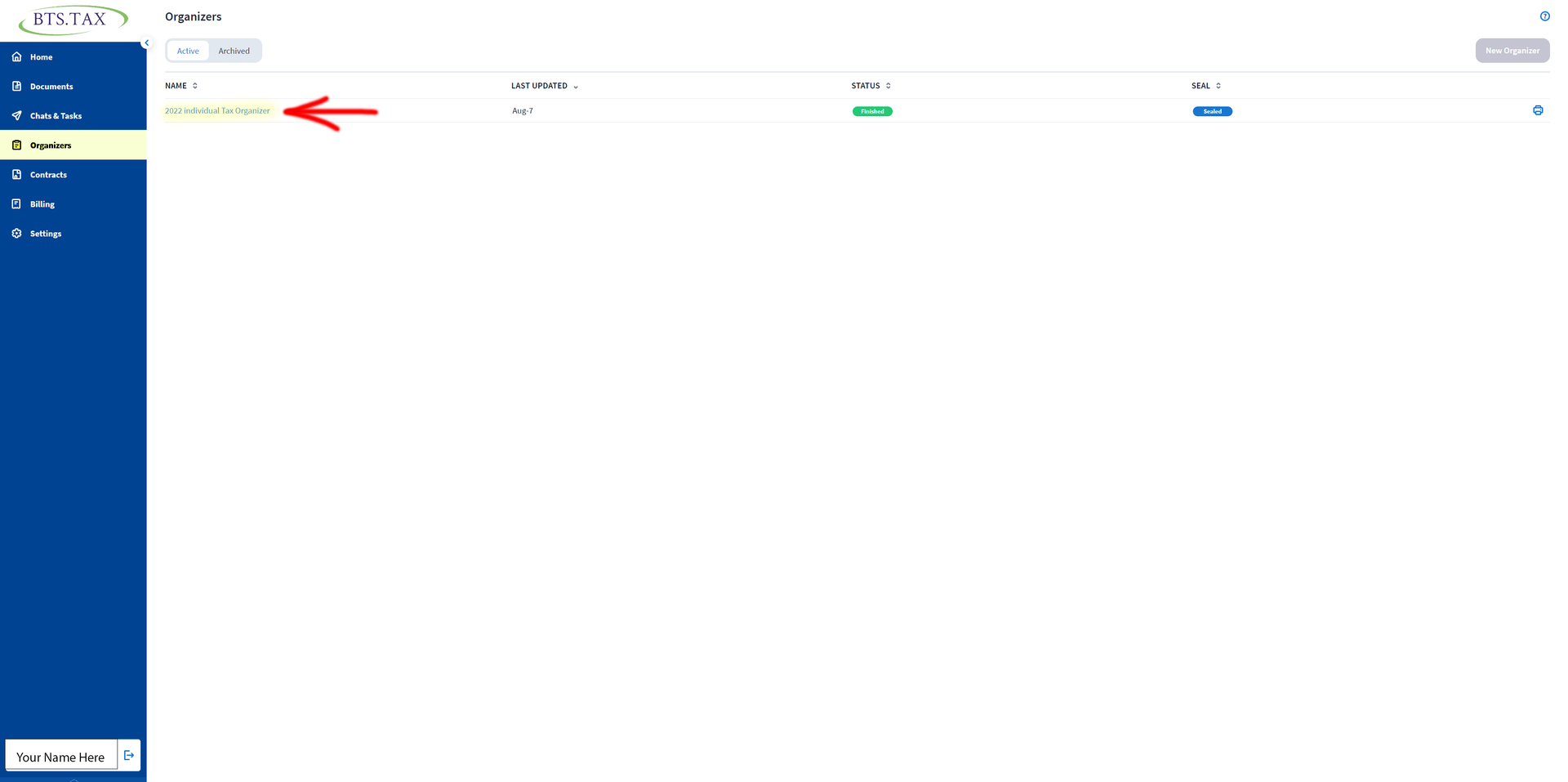

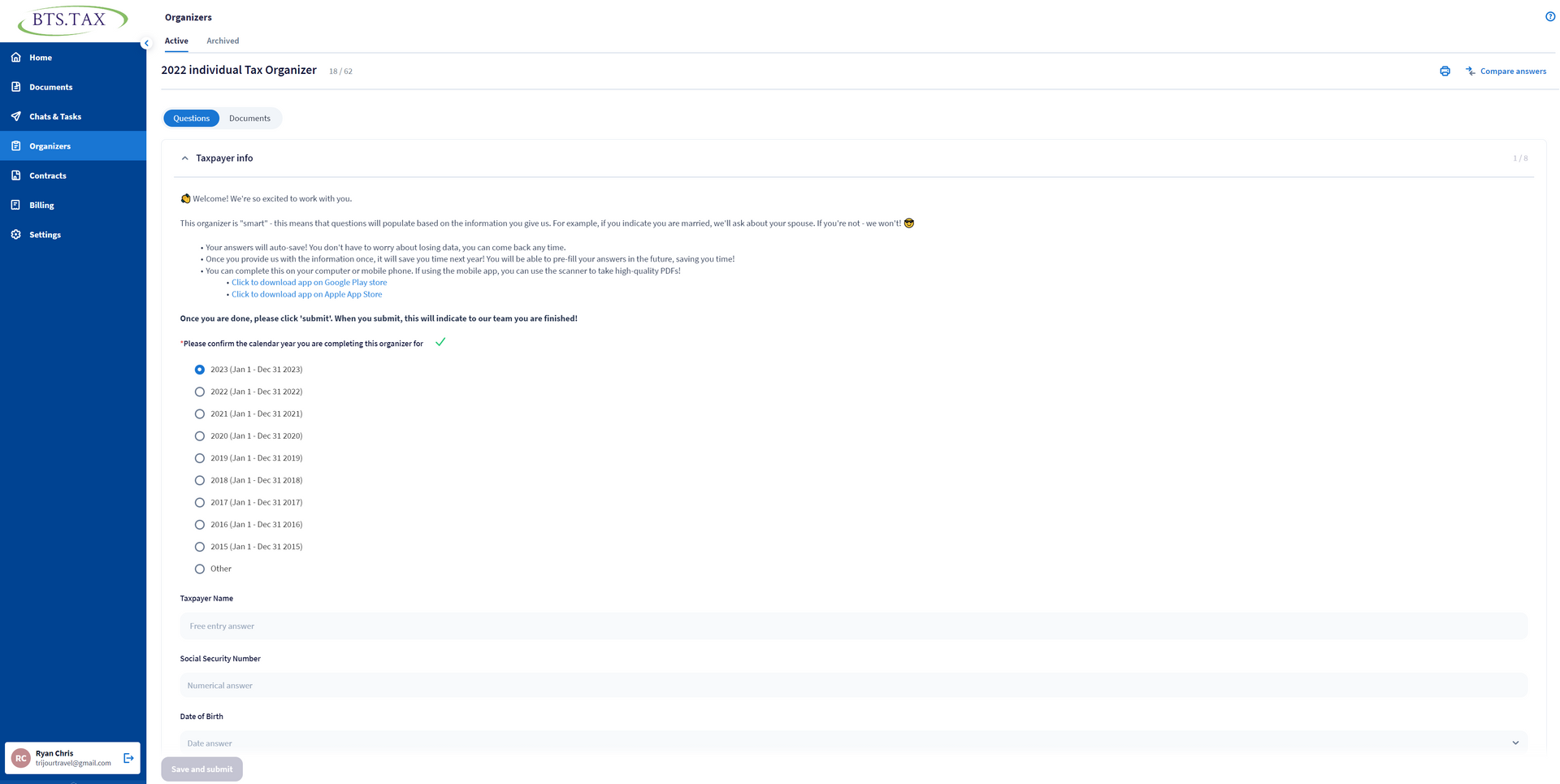

Complete The Tax Organizer: Easy To Navigate

Our tax organizer makes it easy to navigate by asking simple questions to determine the tax documents that will be needed for your return. You will be prompted to upload during the process or at a later time. We even provide a built-in document scanner in our phone app to make it easier. Once completed. you will be assigned to a tax specialist that will introduce themselves and update you on the estimated processing time.

- If you don't have your documents on your computer or access to a scanner, you can conveniently return later using the phone app with built-in scanner.

STEP

3

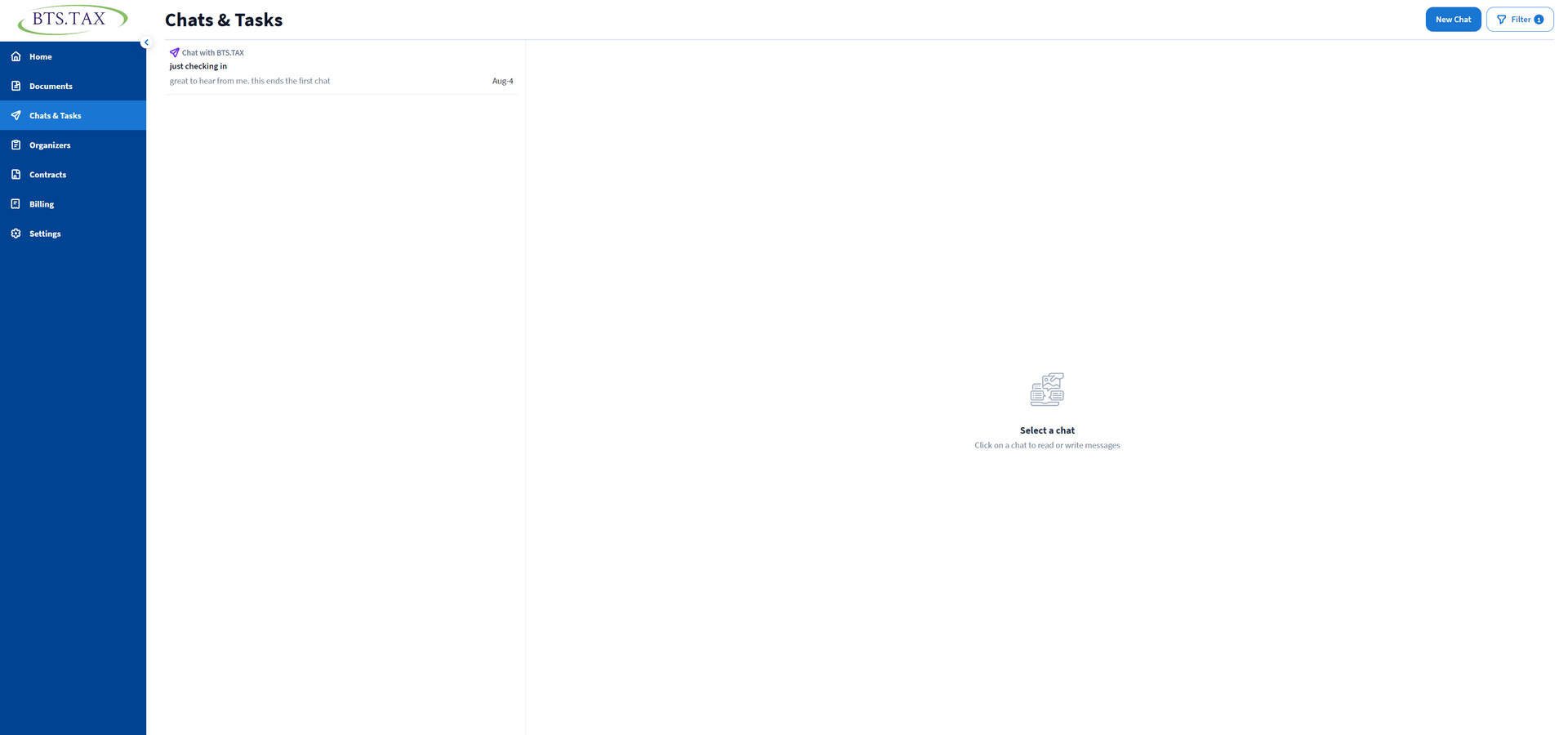

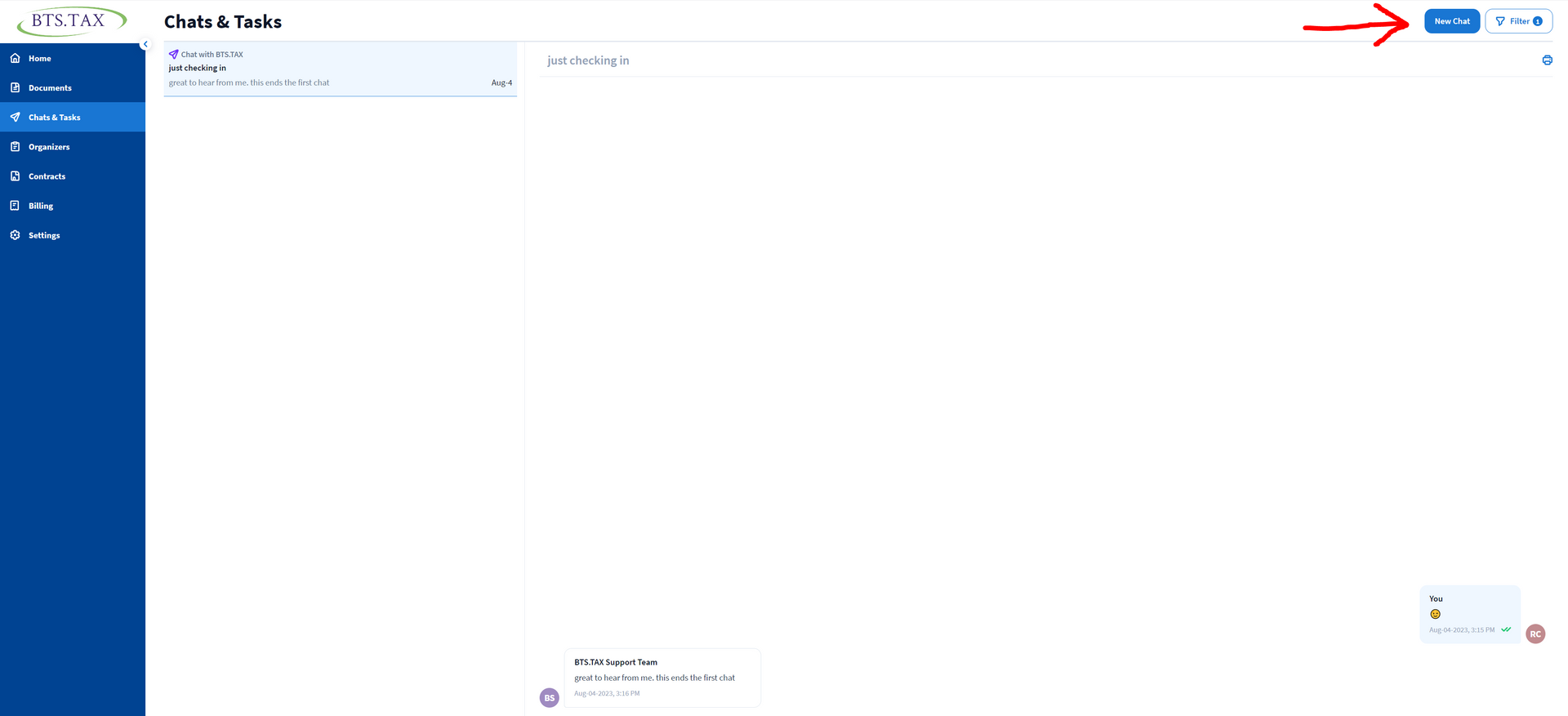

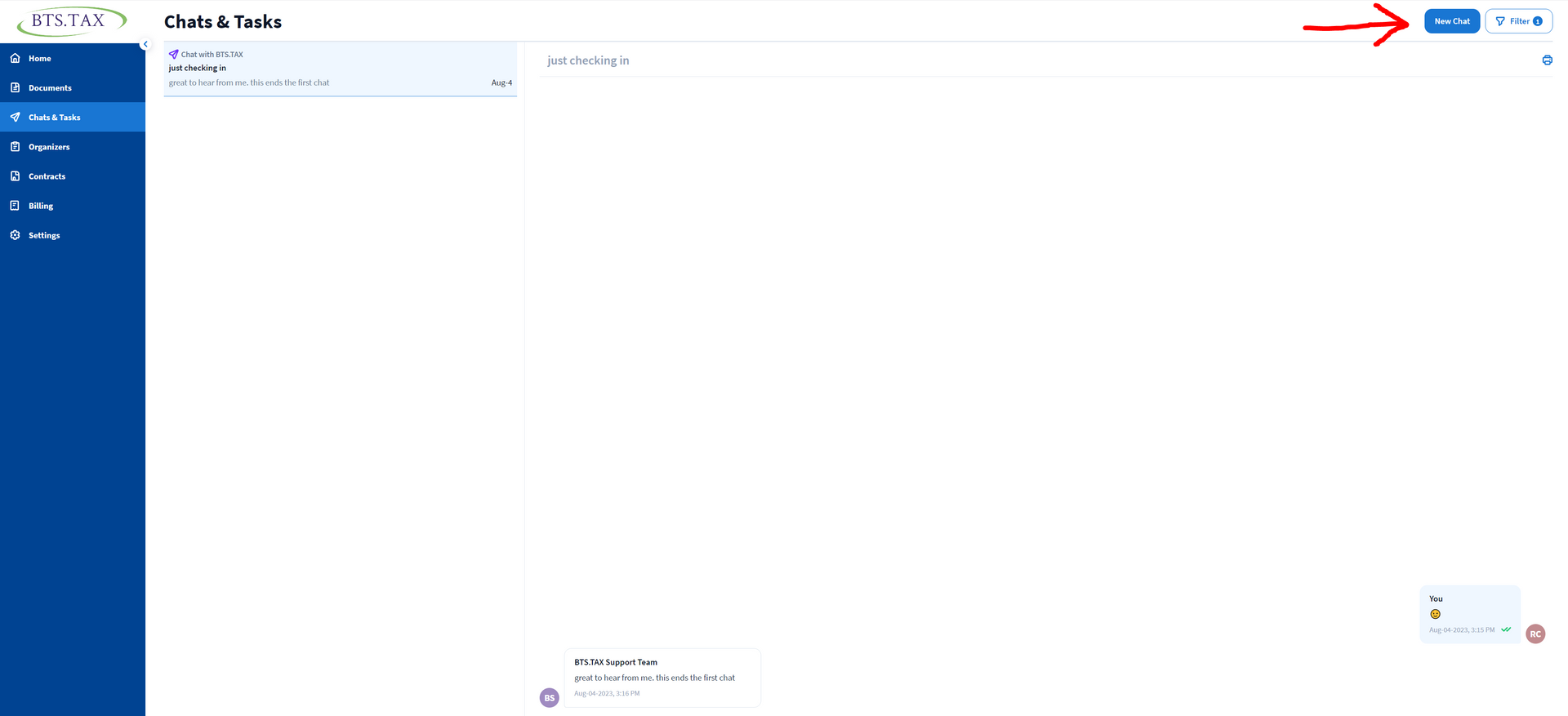

Chats & Tasks: Keeping You Informed

We'll keep you up-to-date with our progress as we search for the best deductible scenarios to maximize your tax return. If we discover any forms you might be missing we'll notify you, once confirmed we'll add a task for you to upload the form. Once you've uploaded it we will be notified so the data can be entered.

- whenever you need to contact you tax preparer just click the New Chat button on the right, indicated with the red arrow. This will start your chat session.

STEP

4

Schedule A Face To Face Review and Complete

As we wrap up your tax statement you will be asked to schedule a convenient time for your face to face review through video conferencing. We review your tax return together and offer any adjustment suggestions to make next year even better. You can then make payments as we e-file your tax return. Once completed you'll have immediate access to a copy of your tax return.

- You will have access to this portal year round should you need to send a copy to your financial institute.

Frequently Asked Tax Questions

Online Security

At BTS.TAX, safeguarding your sensitive personal information is our utmost priority. We go the extra mile to ensure your data is fully protected through a series of stringent measures. Our encrypted portals offer a fortified layer of security, ensuring that your data remains confidential and inaccessible to unauthorized parties. Moreover, our email communications strictly adhere to HIPAA-compliant standards, guaranteeing that your confidential information remains secure during transmission. When it comes to virtual interactions, our video conferencing platforms are also HIPAA-compliant, ensuring that your privacy remains intact even during face-to-face discussions. Rest assured, your information is in safe hands with BTS.TAX, and we're committed to maintaining the highest standards of online security.

Offer and Compromise Tax Debt Relief

The Offer and Compromise program allows taxpayers to propose a compromise to the IRS, stating the reduced amount they can afford to pay to settle their tax debt. To be eligible, taxpayers must meet certain requirements and demonstrate their inability to pay the full amount owed.