Quick Help Guide

Here are a few help guides, FAQ'S, and links. Should you need further assistance that the website does not provide please contact support and/or your tax specialist either through portal chat or by phone.

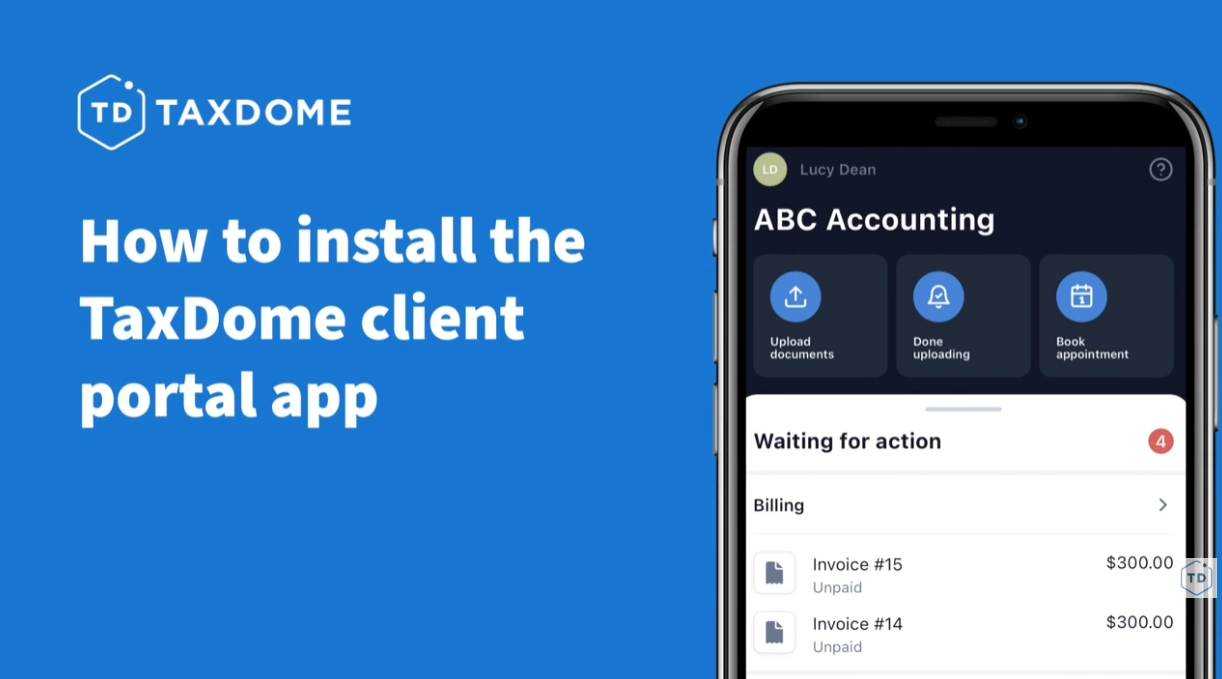

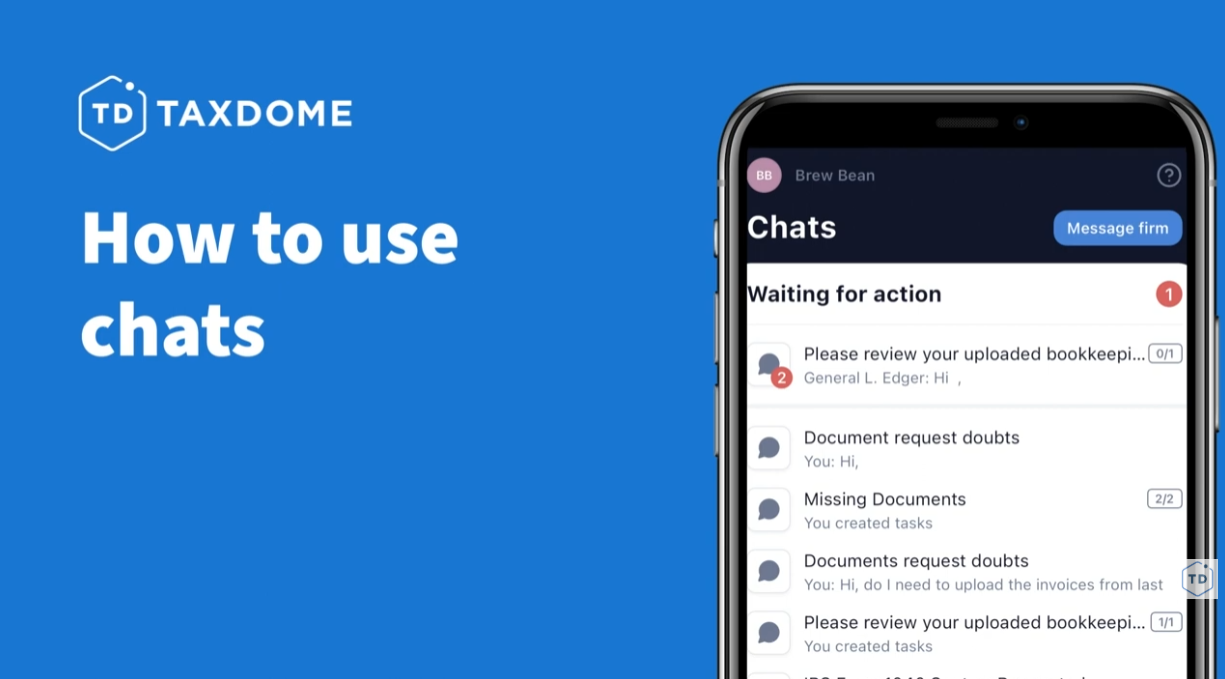

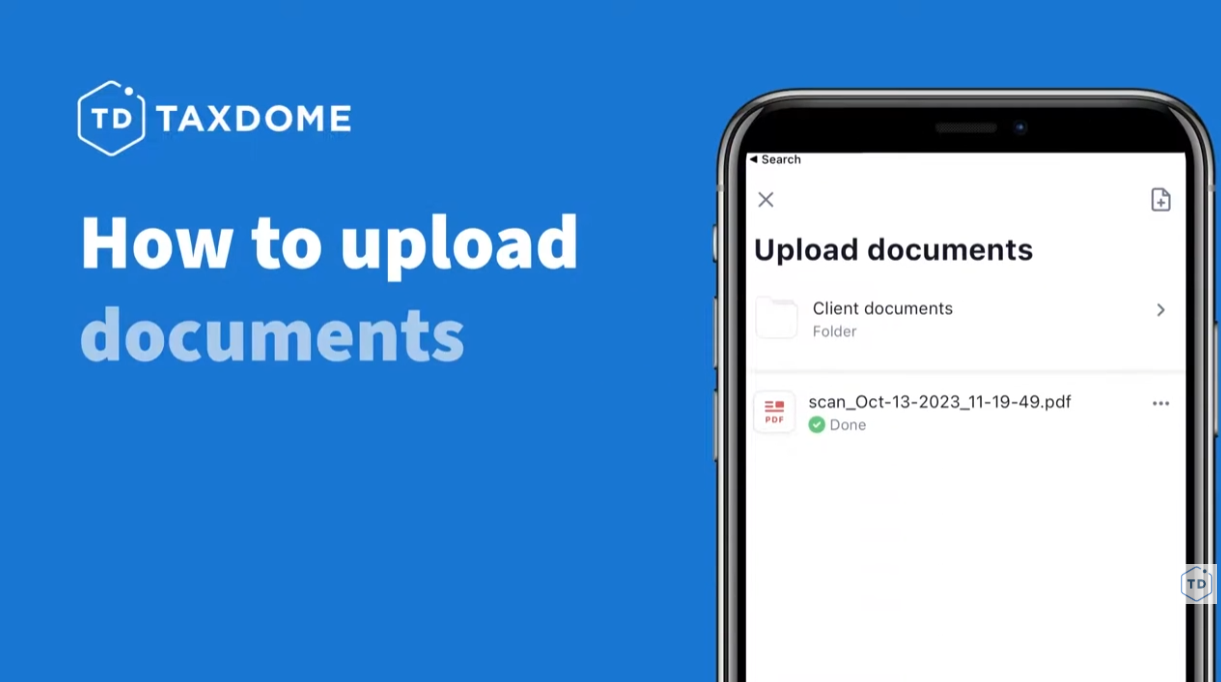

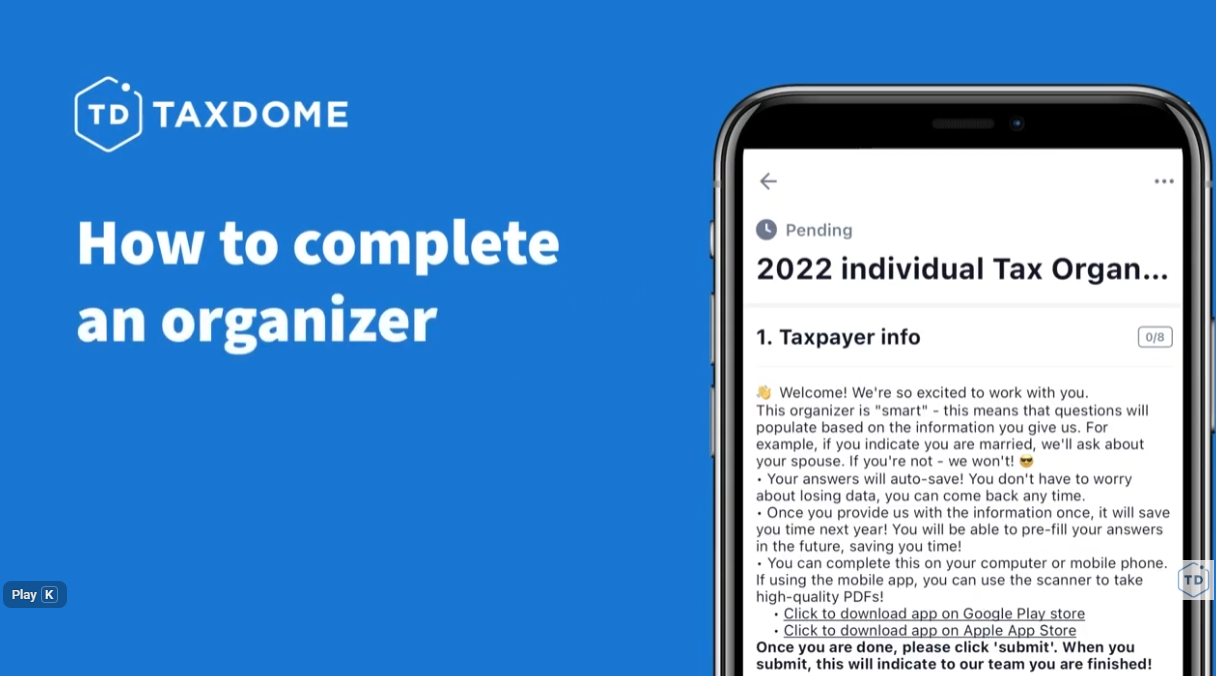

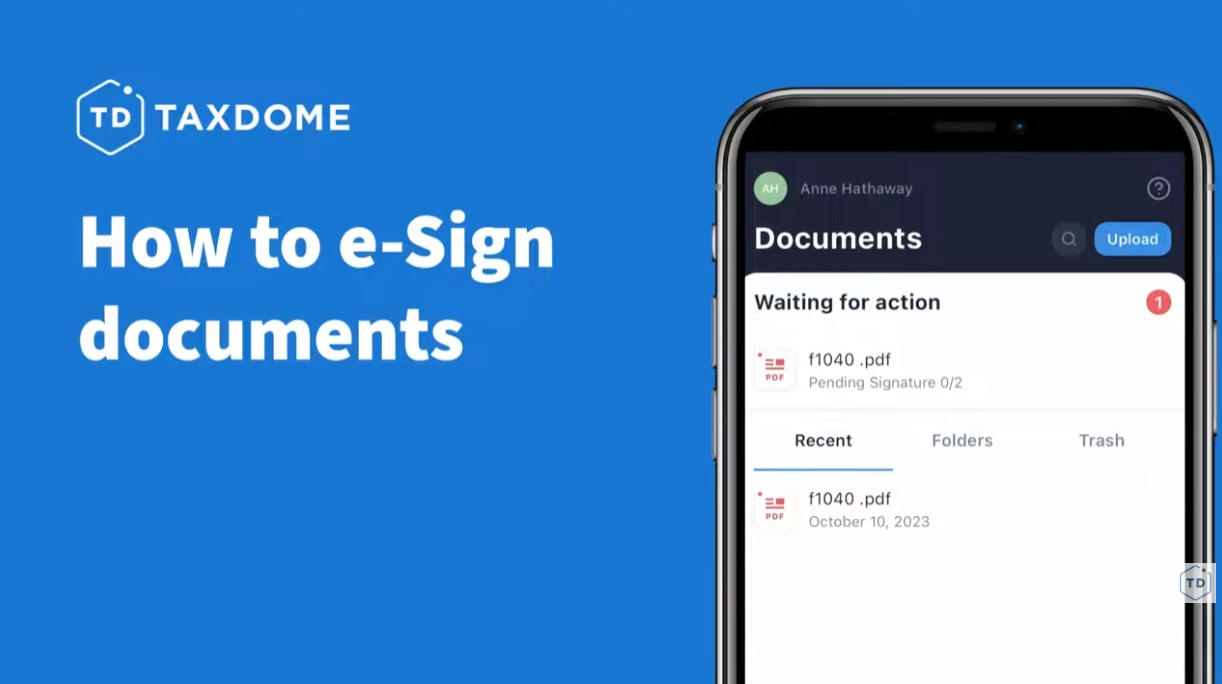

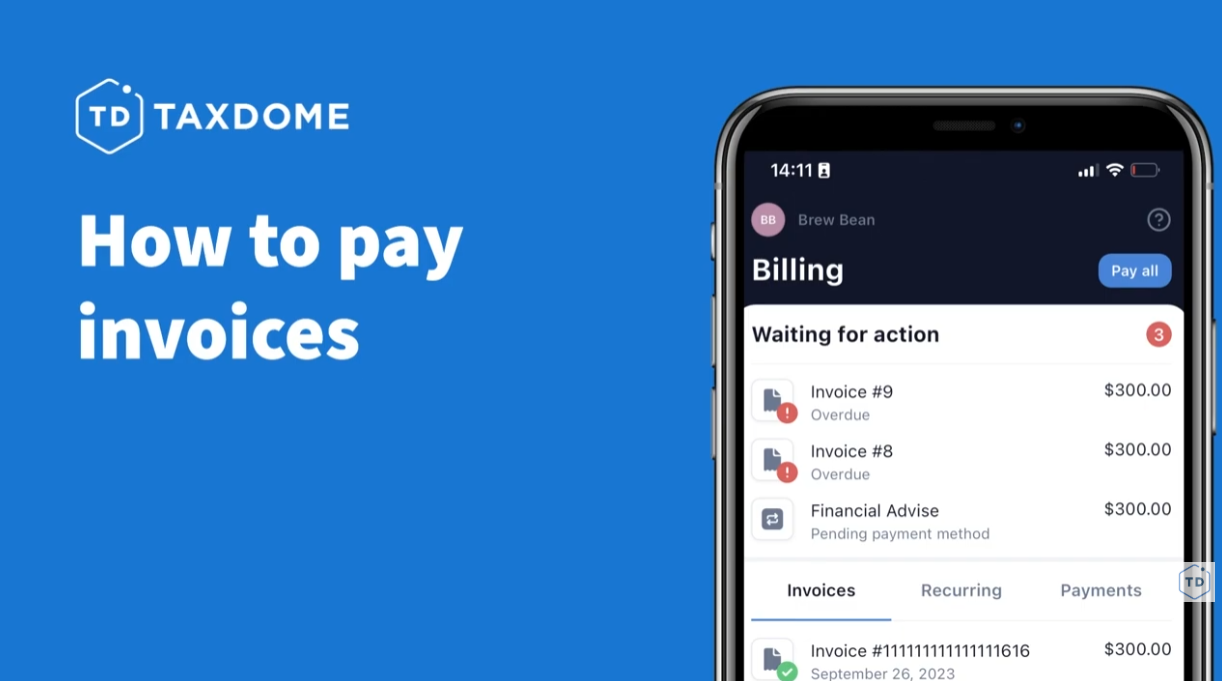

Click on any of the images below to start help video

Tax Processing Status

Get Support and advice all year

Click here for further detailed instructions

Until we file your tax retun you can check your status on our app, ask questions, and get support. After filing you can check the status with the perspective government entities. You can find links below.

3 Ways To Pay Taxes

There are three ways to make payments to the IRS or state income tax obligations.

Scheduled debit(s): Let's us help by scheduling a direct debit from your account on the day of your choosing. No mailing, no credit card charges, and no additional fees. Completely hands free.

Mail In: We'll supply envelopes and vouchers so you can mail in your tax payment(s).

Online: Make you payements directly through the respective website(s). Credit card charges may apply.

Where's My Refund?

Once we've electronicly filed your tax return and is accepted the next stage of processing is out of our hands. However, you can still track the progress thgough the federal and state websites. Click the button below for the requested links.

Amendment Progress Report

Making changes to your tax return and filing an Amendment can sometimes take additional time with the IRS for review.

You can check the IRS status by clicking the button below.

Latest news about selling private info.

Write a description for this tab and include information that will interest site visitors. For example, if you are using tabs to show different services, write about what makes each service unique. If you are using tabs to display restaurant items, write about what makes a specific dish particularly worthwhile or delicious.

-

I lost my email. How do I sign into my prtal?

You do not need your email loink to sign back into your portal. There is a link provided near the top of the page. You can also click this link to sgin in.

-

What if I haven't filed my taxes for the last few years?

Not a problem. However, timing is of the essence. You can only receive refunds for the past three years. However, all tax obligations remain, while penalties and interest continue to accumulate. It’s best to get all your tax years filed to stop the increase of tax obligations. Once complete you can set up a payment plan through the IRS website. Many states also offer similar options. If you owe more than $10,000 we may be able to help reduce your tax burden. Click here to find out more.

-

Do I have to pay penalties if I am late on filing my tax return?

If you have refunds due to you, there are no penalties from the IRS or your state. However if

you will owe taxes then you will have a late file penalty, a late pay penalty and accruing interest

charges from the IRS and state.

-

I was unemployed this year. What papers do I need to bring you to file?

Weather employed or self-employed you will need any documents containing income. Some of the form include but not limited to:

Employed

- W2

Self Employed

- 1099-MISC

- 1099- NEC

- W-2G (gambeling winings)

Additional Incomes include stocks, investments, retiremtn withdraws

- 1099-R

- 1099-INV

- SSA 1099

Other Tax Documents

- 1098 (mortgage statemen)

For a more detailed response talk with yor tax specialist about all types of income that you have received and they will help guide you on the documents and what deductions may be applied.

-

Do I have to claim my gambling winnings?

All gambling winnings are considered income and must be reported. However the IRS does

allow a deduction for losses up to the amount you won. In 2020 the personal deductions were

raised for taxpayers. Your gambling losses are claimed in lieu of your standard deduction along

with other allowable deductions such as donations, property taxes and mortgage interest. If

these amounts do not exceed your standard deduction then there will be no change in your tax

return.

-

How do I get my paperwork to you?

The preferred way to send your tax information is through our online portal which is encrypted

the same as medical encryption. If you do not have that ability or you have a large number of

papers, please call the office and discuss the options. If you are a business please call the office

to discuss your options.

-

What information do you need from me?

Taxpayers should gather Forms W-2, Wage and Tax Statement, Forms 1099-MISC,

Miscellaneous Income, and other income documents to help determine if they're eligible for deductions or credits.

Most income is taxable, including unemployment compensation, refund interest and income

from the gig economy and virtual currencies.

We also will review student loan interest statements, education expenses, child care as

examples

In addition we will need a copy of your current driver’s license or a recognized form of

identification

If you have a refund due we will ask for your deposit information which would be your routing

number and checking/savings account number

If you are claiming dependents, we will need a copy of their social security card

If you have filed with us in the past and we have this information, then we do not need a new

copy

-

What if I need to change a past tax return

At BTS we are able to amend past tax returns that need to be corrected due to any number of

circumstances. If you are a current or past client, your information will be in our system to

amend. If you are new to us we need a copy of the tax return for the year you need to correct.